Simplifying Income Tax with AI.

Embrace the digital tax revolution with APARI Pro and exploit the opportunities at the intersection of AI, personal tax and digital transformation.

Trusted by these key partners

Why APARI Pro?

Meet Ania, our AI-powered Co-Pilot

At APARI, we leverage Artificial Intelligence to transform interactions with the tax system.

Embrace technology that delivers a high return on investment by unlocking new growth opportunities.

Don't get left behind with the future of taxation - join us and be a part of the AI-driven revolution.

What is APARI Pro?

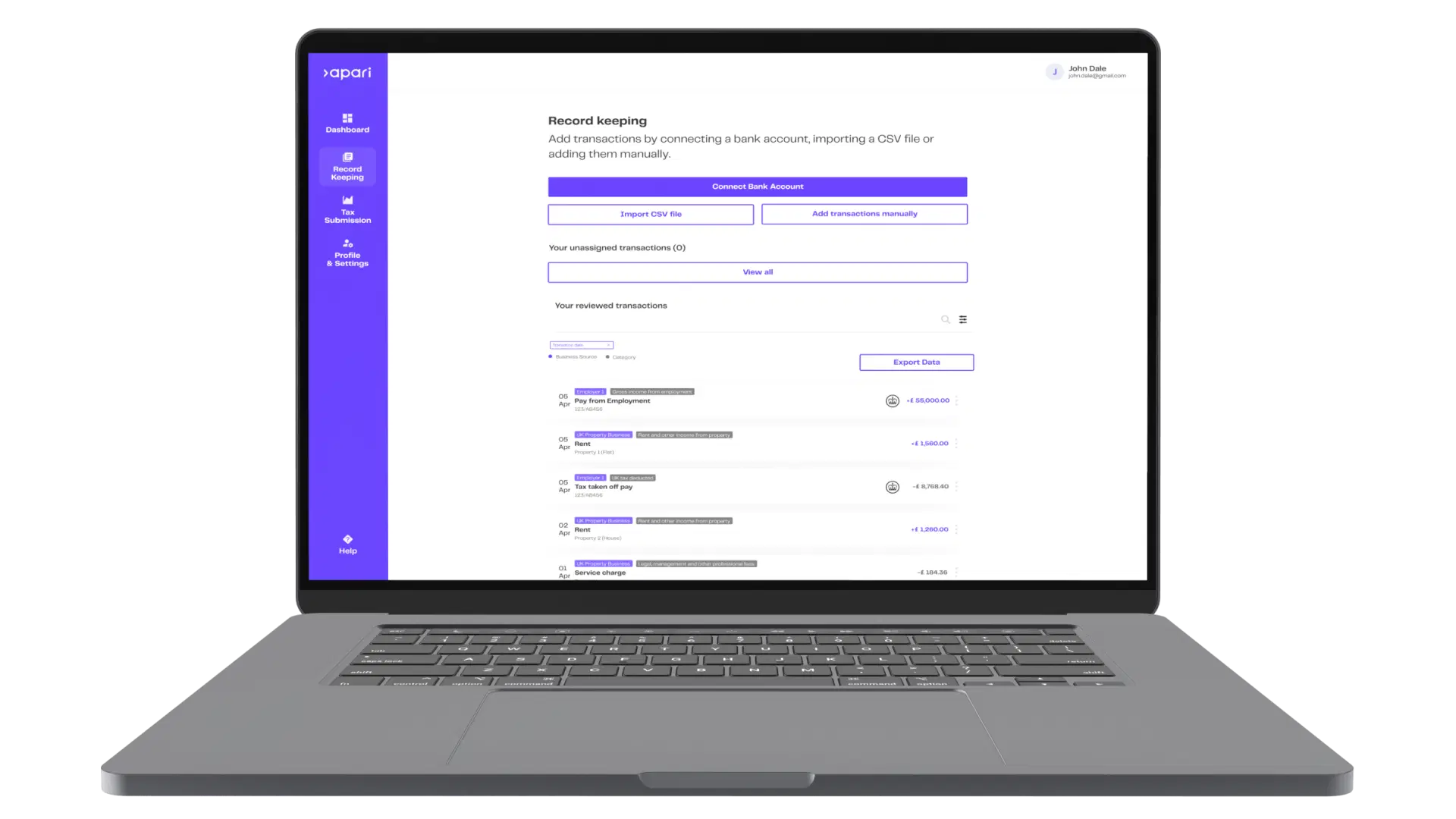

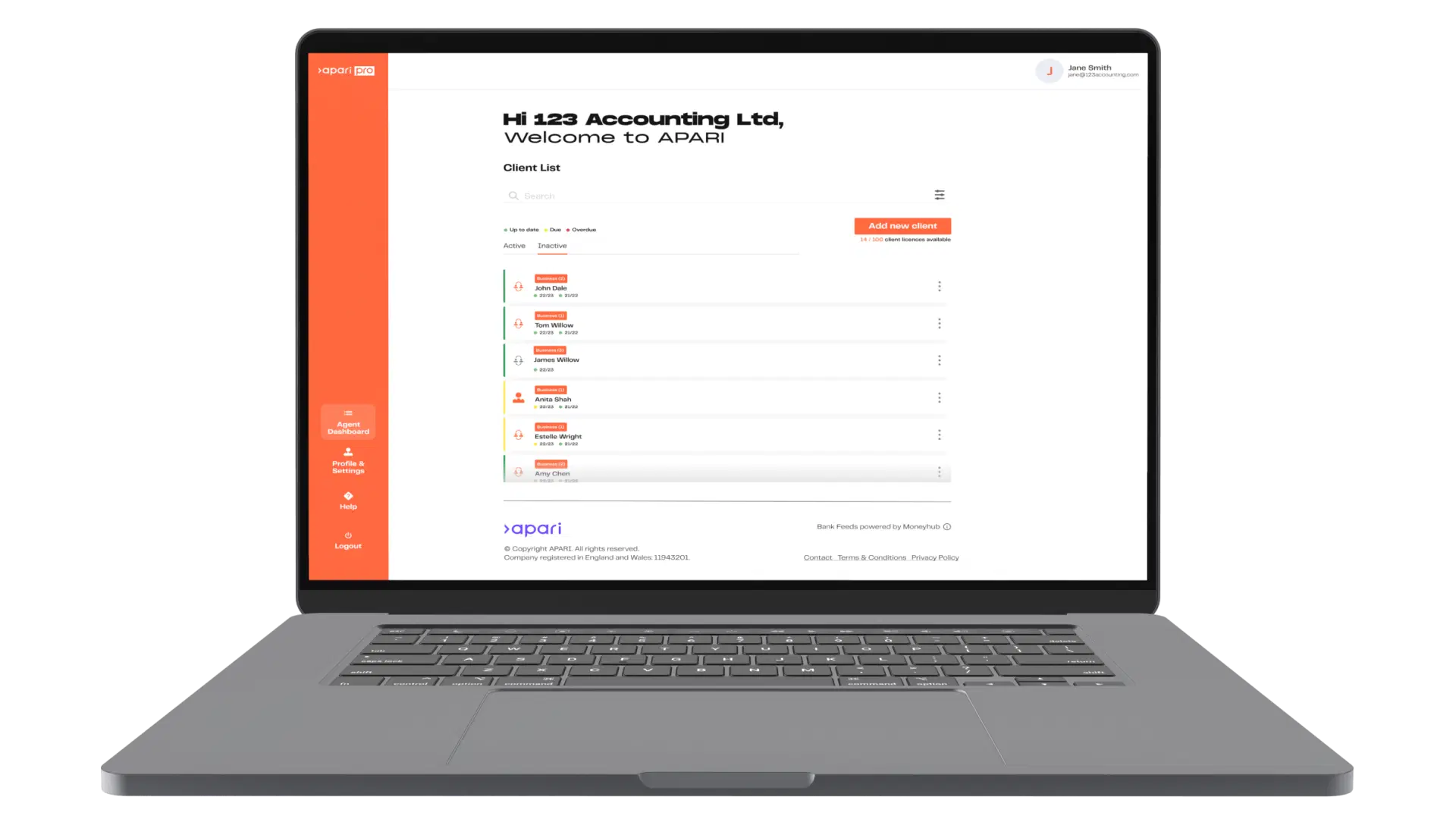

APARI Pro is a digital Self Assessment solution, powered by AI to simplify the preparation and submission of a tax return.

We do this by

Accessing a range of data sources to reduce the effort and admin burden of gathering the relevant information for a tax return.

In-built automation to ensure the relevant areas of a tax form are considered and completed.

Direct submission to HMRC from within the platform.

Our solution is designed for

Enterprise partners - where your service creates tax consequences for your clients, such as investments, pension contributions or earnings through digital platforms.

Accountants - with high volume, low-margin clients that are not suited to traditional accounting software.