Accountants & Bookkeepers

Increase your margin on Self Assessment clients with APARI Pro.

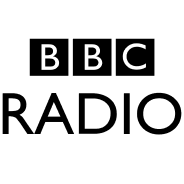

Remove manual data entry and paperwork from your practice with a fully digital Self Assessment:

Automated data capture from banks, letting agents and investment platforms.

Tax compliant allocation & categorisation.

One-click export or submit directly to HMRC.

Featured in

Take back your January©

Over-engineered software doesn’t work for high volume, low margin Self Assessment clients. Get a dedicated tool for digital bookkeeping, remove unnecessary paperwork and take control of your workload.

Increase your margin

Reduce your overheads for low-fee clients and free up time for valued advice that reduces their tax bill.

Digitalise your clients

Automate manual bookkeeping processes, removing paperwork and email attachments from the process.

Spread your workload

Minimise the stress of chasing client information close to the filing deadline and the last-minute work this creates.

‘Helped us migrate from just excel spreadsheets to a simple, direct recording and return process.’

‘Very simple to use software - worth taking on board, even despite MTD delay to 2026.’

‘Very easy to use software - I don’t have a lot of IT skills, but I can use APARI software.’

Future proof Self Assessment

Accountants and bookkeepers learn APARI Pro very quickly

Why APARI Pro?

Keep Self Assessment simple

For clients, such as:

- Sole traders

- Landlords

- CIS workers

- Employees & Pensioners

Future-proof

Quick to onboard.

Easy to use.

No complicated add ons.

Fully HMRC-recognised for annual tax returns and MTD.

Cutting edge technology

Streamline client engagement with our AI and automation.

Cloud based, so you can access anywhere and on any device.

Integrates with

Our pricing is straightforward

Each client licence costs £50.

Prices exclude VAT.- It’s free to create your Accountant Portal.

- For each client you add, you’ll require a licence. It can be paid by you or by your client directly.

- A single licence gives full access for one client for one tax year e.g. from 6 April 2023 to 5 April 2024.

There’s a minimum purchase of five licences to begin using the service.