Digital platforms

The proliferation of digital platforms has meant tax authorities are taking action regarding the loss of tax revenue attributable to undeclared income.

As of 1 January 2024, digital platforms have legal obligations to submit seller earnings data to HMRC. If there's a mismatch with the seller's tax return, they will face a tax enquiry.

APARI Pro offers you cutting-edge tax technology to exploit the opportunities at the intersection of AI, personal tax and digital transformation.

Improve your customer offering

Brand reputation

Be seen as a platform that takes pain away from sellers and increase influence by supporting government objectives.

HMRC compliance

Meet the new digital platform reporting obligations and reduce the risk of tax enquiries for your sellers.

Seller proposition

Our cutting-edge tax technology reduces admin costs for sellers and helps them to optimise their tax liability.

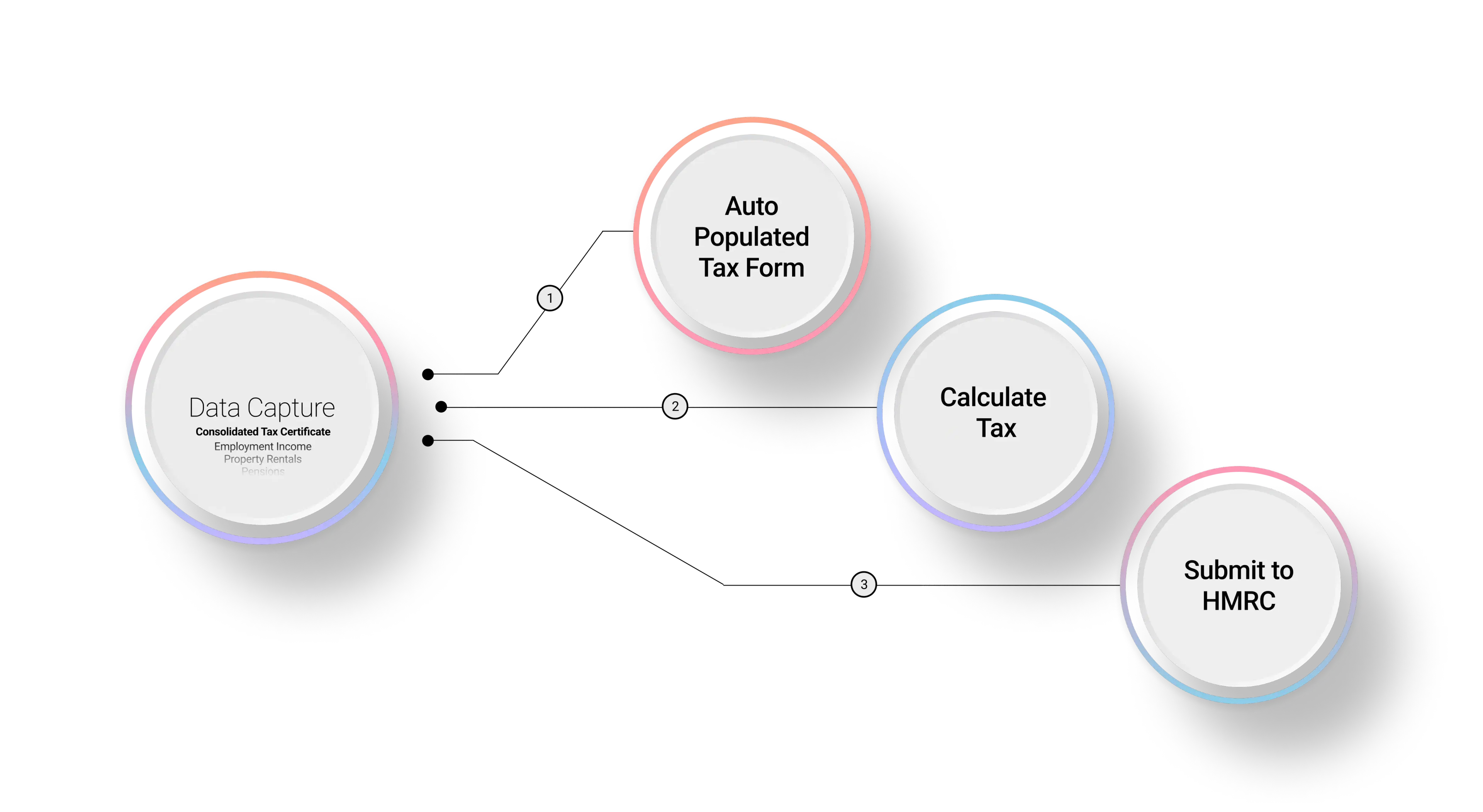

How APARI Pro works

A product you’re proud to offer

APARI Pro is fully HMRC-recognised. We deliver simplicity to your clients and take away the stress of tax.