Pensions

Higher rate taxpayers have failed to claim £1.3 billion in pension tax relief over the last 5 years.

Whilst most pension providers claim basic rate tax relief at source; higher rate taxpayers must submit a self assessment tax return to claim additional tax relief.

APARI Pro makes it easier for your customers to do this whilst also providing real-time tax calculations to encourage them to make additional contributions.

Help customers claim tax relief & increase contributions

Optimise claimable tax relief

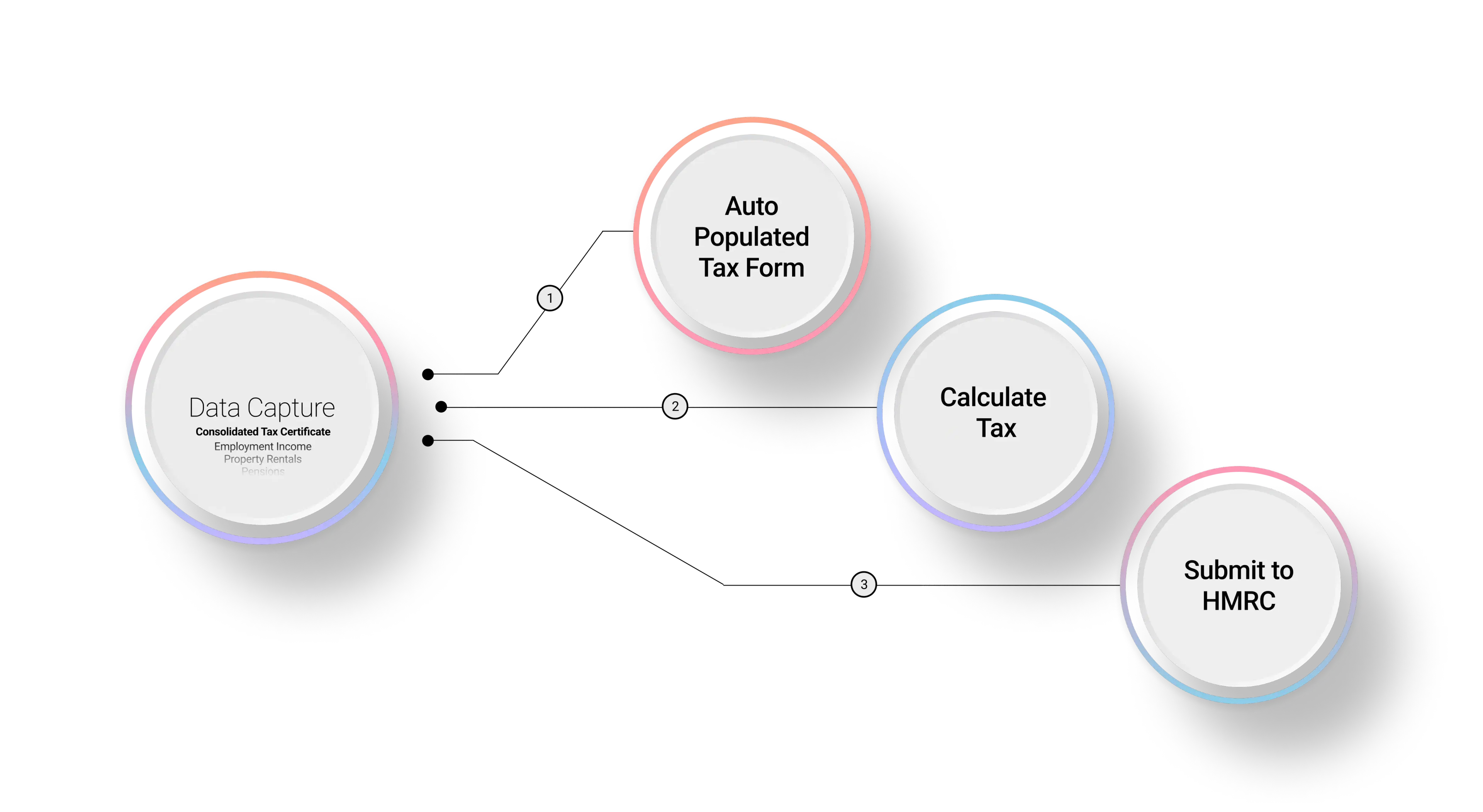

Customers can auto-populate, prepare and submit tax return; without leaving your system making it easier to claim tax relief.

Data driven advice

Advise on the most tax efficient pension contributions and investments with our HMRC-recognised tax calculator.

Improve client retention

Become the go-to platform for your customers to consolidate their pensions with our easy to use, tax compliant solution.

How APARI Pro works

A product you’re proud to offer

APARI Pro is fully HMRC-recognised. We deliver simplicity to your clients and take away the stress of tax.